- Hnew average inventory formula update#

- Hnew average inventory formula manual#

- Hnew average inventory formula software#

It affects the revenue amount your business is reporting as well as the tax amount that you end up paying. You must know that the costs of goods sold will be different while using different costing methods (FIFO v/s LIFO v/s moving average) in a specific time or a financial year. That is why it is more efficient to use this formula to generate your actual cost of goods sold no matter how many/many products you sell on an order. All you have to keep in mind is keeping in mind about your unit cost after every PO this method recalculates unit costs. You can easily calculate the cost of goods sold by multiplying the amount of your sold products with your existing unit cost. It will help if you are careful about recording everything in the exact amount and time. It recalculates the average cost per unit with additional stock purchase every time. Moving average accounting eliminates all the extra costing layers to generate updated results. On the contrary, moving average cost calculation is not suitable for periodic inventory system as it gathers all the information at the end of every accounting period. In moving average price system keeping up-to-date records of inventory balances get more manageable because it captures and factors the records at the individual unit level. Moving average accounting keeps changing with the occurrence of new purchases, which makes this method only ideal for a perpetual inventory tracking system. It is necessary to record and count the landed costs into the cost of the purchased goods to get accurate results on your moving average calculations. It becomes even more complicated when the company uses the stock from other purchase orders to meet the sales order. Multiple cost layering biases the results of the profit or cost of the goods sold. It does not require any extra cost layering like other costing methods. This way, the cost of ending inventory and the cost of goods sold to match the average cost. With this software, you can simply differentiate the unit costs over time to time and so many more.įor your moving average cost calculation, divides the number of items in inventory by the total expense of the purchased goods.

Hnew average inventory formula software#

Some of this software generates financial reports and analyses, but some of these also predict risks and generate different estimations and methods to meet the organizational goals better. But it also needs for the accountants to keep it in proper check.ĭifferent software is designed for handling these crucial calculations meeting all the requirements for the business. With Excel, you can set up the formula to continue the calculations in the same way with new changes of data from previous cells.

Hnew average inventory formula manual#

With advanced technology and systems, the manual recording is out already outdated.

Hnew average inventory formula update#

You can track it by using macro in a spreadsheet and update the values of the orders of your goods. Companies are using automated computerized software and program to keep the tracks of your moving average costs updated. Moving average accounting helps the companies to generate financial results accurately. Video Credit: Accounting Stuff Tracking Your Moving Average Inventory Costs: But if you want to know about your business and products’ updated price, using the moving average pricing will give you a heads up. Generating a moving average is complicated and not a time-saver always. This method is also applied to generate the company’s gross profit margin by recording inventories, computing its’ assets, generating net sales, and the cost of the products sold. Using the moving average costing method, keeping track of the financial position gets easier and more efficient. In these cases, the moving average costs combine all the factors and generate a new selling price. When you already have stock in your inventory but also receive new lots, it is obvious that the new delivery will be different in price than the previous ones. Companies that deal in large quantities like liquids, nuts, nails, etc., can be pretty tricky. Usually, it gets easier to track the inventories when the goods can be counted individually or sold in bulk. Companies focus on selling the products and reducing the existing stocks at hand as well.

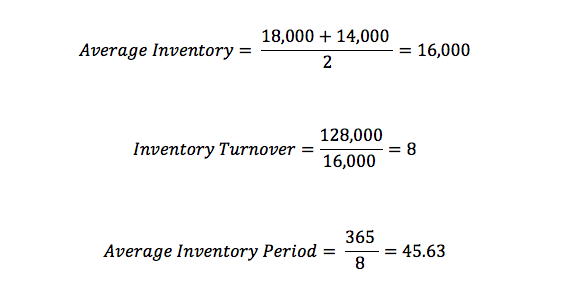

Why is the moving average Inventory important?Ĭhoosing to use the moving average cost formula in your business ensures that your cost is always up to date. To get the results between LIFO and FIFO method, organizations are nowadays using the moving average formula. We know the most popular costing methods are LIFO and FIFO, where they focus on different variables to generate results. Each method generated different levels of profits and cost of goods sold, focusing on various elements. It is essential that you know about the functioning of the moving average inventory methods.

0 kommentar(er)

0 kommentar(er)